February 17, 2024 Updates

To date, of the 2,815 bills and resolutions introduced, 1,011 have been passed in the House and 725 have been passed in the Senate. The legislature has chosen not to advance 814 bills and continued 333 bills to the 2025 session. As the session proceeds, we will continue to update our bill tracker with the most up-to-date information. Click below for the latest updates.

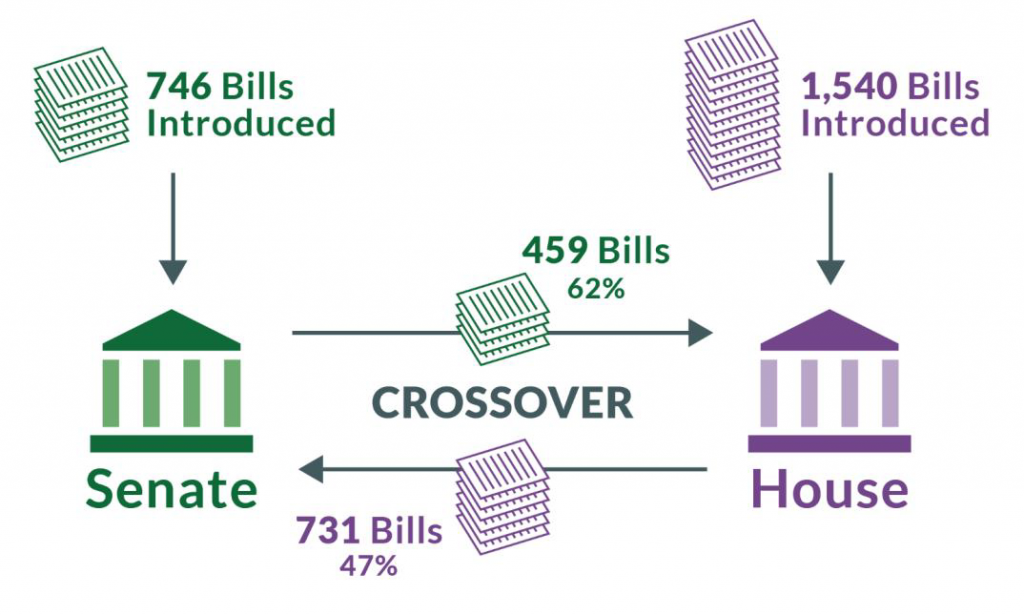

This past Tuesday was crossover, the General Assembly’s deadline for bills to pass out of their body of origin to be considered by the other body. As of last Tuesday, the House will only be considering bills that passed from the Senate and the Senate will only be considering bills that passed from the House.

Of the 1,540 bills introduced in the House and the 746 bills introduced in the Senate before Tuesday, just over half of them survived through crossover. 47% of the bills in the House advanced to the Senate and 62% of the bills in the Senate advanced to the House.

February 18, 2024, marks “Budget Sunday,” when the House Appropriations and Senate Finance and Appropriations committees will adopt their respective budget bills. The complete text of budget amendments is scheduled to be released on Tuesday, February 20, 2024. All budget-related decisions must be finalized by Thursday, February 22, 2024.

Please see below for some legislative updates from the past week.

PUSH TO INCREASE THE MINIMUM WAGE PASSES THROUGH BOTH BODIES

As mentioned in previous reports, HB 1 (Ward) and SB 1 (Lucas) seek to increase the minimum wage from $12/hour to $13.50/hour, with an effective date of January 1, 2025. These bills will also increase the minimum wage from $13.50/hour to $15/hour, with an effective date of January 1, 2026, for this increase.

The House version of the bill was passed in the House and is now awaiting action in the Senate Commerce and Labor Committee. The Senate version of the bill was passed in the Senate by a 21-19 party-line vote this past Tuesday and was referred to the House Labor and Commerce Committee.

Further updates to come as this legislation continues to move through the process.

FINAL DATA CENTER BILL ADVANCES IN THE HOUSE

As highlighted in last week’s report, HB 338 (Thomas) was amended in a subcommittee of the Counties, Cities, and Towns Committee with two amendments that:

• Make it optional, rather than a requirement, to perform a site assessment to examine the effect of the data center on water usage and carbon emissions within the locality, and

• Strikes the language that referenced the examination of the impacts of a data center on agricultural resources.

The amended version of the bill was passed by the House by a vote of 55-42-1 this past Tuesday. At the time of this report, the bill is awaiting a committee assignment in the Senate.

As this legislation continues to move through the process, further updates will be provided.

COCKTAILS TO-GO LEGISLATION PASSED BY BOTH BODIES

The Prince William Chamber has partnered with the Distilled Spirits Council, the Virginia Restaurant, Lodging and Travel Association, Virginia Spirits Organization, and the R Street Institute to support legislation that will make cocktails to-go permanent for ABC-licensed restaurants in Virginia.

These bills were passed by both chambers of the General Assembly and crossed over to the other body where they were heard in committees this past week.

HB 688 (Leftwich) was supported by the members of the Senate Rehabilitation and Social Services Committee, receiving a unanimous vote Friday morning.

SB 635 (Rouse) was passed in the House General Laws Committee with a 20-2 vote on Thursday.

The expectation is both bills will continue to move forward in the coming week.

LEGISLATION TO ENCOURAGE K-12 STUDENTS TO OBTAIN CAREER AND TECHNICAL EDUCATION CREDENTIALS ADVANCES

The Prince William Chamber joined a number of other organizations in supporting SB 563 (Hackworth), which seeks to eliminate the need to take a virtual course in order to graduate and specifies that the classes offered relating to earning career and technical education credentials for high school graduation are required to be high-demand career and technical education credentials. This bill was passed in the Senate with a unanimous vote earlier this week and has been referred to the House Rules Committee.

4

HB 1345 (Anthony) seeks to require the Board of Education, in collaboration with Virginia’s Community College System, to develop and maintain a list of industry-recognized workforce credentials eligible to meet high school graduation requirements. This bill was passed in the House by a unanimous vote this past Tuesday and is awaiting a committee assignment in the Senate.

SB 27 (Stanley), which seeks to establish the Public School Trades Incentive Program and Fund for the purpose of providing grants to any school board that would like to create programs for high school and middle school students to learn skilled trades that lead to earning certifications or credentials, has been assigned to the House Appropriations Committee’s Elementary & Secondary Education Subcommittee for consideration there.

Further updates to come as this legislation continues to move through the process.

EXPANSION OF VIRGINIA’S HISTORIC REHABILITATION TAX CREDIT PROGRAM PASSES IN BOTH BODIES

The Prince William Chamber has joined other chambers, business and environmental organizations, and localities in support of expanding the Virginia Historic Rehabilitation Tax Credit Program, which has played an essential role in preserving more than 2,500 historic properties and economic sustainability of communities in the Commonwealth for 27 years.

As introduced, HB 960 (Lopez) and SB 556 (Williams Graves) sought to increase the maximum amount of

that tax credit that may be claimed by a taxpayer from $5 million to $10 million beginning in 2024.

The House version of the bill, which was amended to add a cap on the program of $75 million per fiscal year, was passed in the House with a vote of 62-37 earlier this week. The Senate version, which does not include the program cap, was passed in the Senate by a unanimous vote this past Monday and has been referred to the House Finance Committee.

We continue to urge lawmakers to remove the program cap, which would have a devastating effect on the program. While the focus is on urging support for the bill without the cap, we have been assured that if the program cap cannot be removed, the bill will not advance, leaving the program as it is today.

As this legislation continues to move through the process, further updates will be provided.

LEGISLATION TO INCREASE AFFORDABLE HOUSING OPTIONS PASSES THROUGH THE HOUSE AND SENATE

A few bills that were highlighted in previous reports have advanced over the past week.

HB 1105 (Carr), which seeks to create the Zoning for Housing Production Fund, a grant program through which localities can apply to receive funds to create and maintain affordable housing in mixed-income communities, was passed in the House by a vote of 86-13 this past Tuesday.

SB 597 (McPike), which seeks to authorize localities to provide for an affordable housing dwelling unit program by amending the zoning ordinance, was passed in the Senate earlier this week by a 21-19 party-line vote and has been referred to the House General Laws Committee.

Further updates to come as this legislation continues to move through the process.

Other highlights from week #6 are provided below.

JANUARY GENERAL FUND REVENUES REMAIN CONSISTENT WITH FORECAST

(February 14, 2024) Governor Glenn Youngkin announced that general fund revenues for January 2024 remain in line with the consensus revenue forecast. For the month of January, Virginia experienced a 2.5 percent decline in comparison to the same period last year, despite an extra collection day relative to the prior year. Year-to-date general fund revenues are up a moderate 5.3 percent through the first seven months of Fiscal Year 2024. The slight decline was driven largely by a dip in non-withholding collections and lower-than-expected individual income tax refunds related to the elective Pass-Through Entity Tax (PTET), while other major revenue sources were generally in line with expectations.

“The Commonwealth’s January revenues show that our conservative forecast remains prudent as conflicting economic signals continue to cloud definitive conclusions in the fiscal year,” said Governor Glenn Youngkin. “Virginia’s labor market remains tight and we continue to monitor withholding and non-withholding patterns as we start a new calendar year. This month’s report confirms we budgeted appropriately when releasing our Unleashing Opportunity budget in December and as the budget process moves forward in the General Assembly this weekend, we can all be confident the topline forecast remains prudent.”

“While PTET-related collections and refunds continue to distort overall revenue collections, underlying revenue growth in our major revenue sources remains on or slightly ahead of forecasts,” said Secretary of Finance Stephen Cummings. “We are confident in our conservative revenue forecast and we are continuing to monitor revenue collections and economic data. Given these downside risks, we will maintain a cautious outlook going forward.”

Among the major revenue sources, net individual income tax collections, corporate income tax, and interest income are all slightly elevated relative to last year, while sales and use tax collections, insurance premiums, and wills, suits and deeds are all lower year-to-date. The full January 2024 revenue report is available here.

COSTAR GROUP TO RELOCATE GLOBAL HEADQUARTERS TO VIRGINIA

Upcoming dates and deadlines are listed below.

•February 13th – Crossover (otherwise known as the half-way point of the session when all bills must be acted on in their body of origin).

•February 18th – “Budget Sunday,” when the House and Senate money committees will recommend their proposed budgets.

•

(February 13, 2024) Governor Glenn Youngkin announced that CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information, and analytics for commercial and residential property markets, will invest $20 million to relocate its global headquarters from Washington, D.C. to Arlington County. The company purchased 1201 Wilson Boulevard, a 560,000-square-foot office building in Rosslyn known as Central Place Tower and will occupy 150,000 square feet of commercial office space in late 2024. The move to the new headquarters will include 500 relocated jobs and 150 new jobs to the Commonwealth.

“Virginia’s a great choice for a new corporate headquarters location, and we are excited that CoStar Group, a leading provider of online real estate marketplaces, information, and analytics in the property markets, sees the economic advantage in moving to the Commonwealth,” said Governor Glenn Youngkin. “As states compete for business and jobs, the Commonwealth’s diverse, world-class talent, exceptional quality of life and stable business climate continues to stand out. We are proud that CoStar has chosen Virginia as its home.”

“It is an honor to welcome CoStar Group’s global headquarters to Arlington County, complementing the company’s major research and development operations in the City of Richmond,” said Secretary of Commerce and Trade Caren Merrick. “Virginia represents a diversified ecosystem of more than 800 corporate headquarters in a broad cross-section of industries, and our overarching advantage cited is the ability to recruit top talent. We are building the workforce of the future in the Commonwealth so that industry leaders like CoStar Group continue to reinvest here.”

“The financially strategic acquisition of this building will provide the perfect home for the more than 500 employees at our current headquarters. We’re incredibly thankful for our 14 years calling Washington, D.C. home, and we will continue to be a part of this community even as we move across the river to Arlington County,” said Andy Florance, Founder and Chief Executive Officer of CoStar Group.

“CoStar Group’s strategic move to Arlington reinforces our attractiveness as a hub for innovative global businesses,” said Libby Garvey, Chair, Arlington County Board. “We are thrilled to welcome Costar Group to Rosslyn, where their presence is sure to have positive economic impacts and will help to strengthen the neighborhood — especially with the faster realization of a reconstructed Gateway Park.”

“I extend a warm welcome to the CoStar Group. The decision to relocate the CoStar headquarters to Arlington County reinforces the positive environment state and local leaders have created for business,” said Senator Barbara Favola. “The well-educated workforce, world-class public schools, transit opportunities, and recreational spaces will be welcome assets for CoStar employees.”

Founded in 1987, CoStar Group (NASDAQ: CSGP) is a leading global provider of online real estate marketplaces, information, and analytics in the property markets. The company is on a mission to digitize the world’s real estate, empowering all people to discover properties, insights and connections that improve their businesses and lives. CoStar Group has grown to over 6,200 employees in 14 countries and is included in the S&P 500 Index, one of the premier benchmarks of the U.S. equities market, and in the NASDAQ 100, one of the world’s largest preeminent large-cap indexes.

CoStar Group established its headquarters for research and data analytics in the City of Richmond in 2016 and now employs more than 1,000 team members, representing one of the top 25 largest employers in the city. In 2021, CoStar announced plans to build a corporate campus in Richmond, creating an additional 2,000 new jobs. The new campus will be approximately 750,000 square feet of new office and retail space and is expected to include a 26-story, LEED-certified office building and a six-story, multipurpose building to be used as a central location for employee amenities.

The Virginia Economic Development Partnership worked with Arlington Economic Development to secure the project for Virginia. Governor Youngkin approved a $1.25 million grant from the Commonwealth’s Opportunity Fund to assist Arlington County with this project. The Governor also approved $3.5 million in funds from the Virginia Economic Development Incentive Grant. Funding and services to support the company’s employee training activities will be provided through the Virginia Jobs Investment Program.

SPACE ELECTRONICS SYSTEMS LEADER TO EXPAND IN VIRGINIA

(February 13, 2024) Governor Glenn Youngkin today announced that Trident Systems, a LightRidge Solutions Company and a leader in multi-function space electronics and integrated C4ISR (command, control, communications, computers, intelligence, surveillance, and reconnaissance) solutions, is investing $3.7 million to expand capacity at its operation in Fairfax County for the production of space electronic systems for the U.S. Government, Department of Defense, and U.S. Intelligence Community. The project will create roughly 50 new jobs.

“Trident Systems’ expansion demonstrates the strength of the Commonwealth’s aerospace and tech ecosystem.” said Governor Glenn Youngkin. “This homegrown Fairfax County company has grown its business in the Commonwealth for nearly 30 years, and its continued innovation in space electronics is at the heart of this production expansion to serve the defense and intelligence communities.”

“The Commonwealth offers the location, infrastructure, and robust workforce to provide fertile ground for start-ups, and Trident’s success over three decades is a prime example of what can be accomplished in Virginia with all the right assets,” said Secretary of Commerce and Trade Caren Merrick. “I congratulate all the partners involved in securing this project that will create approximately 50 high-tech new jobs for local citizens.”

“Trident’s rapid growth providing unique solutions that maximize our customer’s mission impact enabled the need for this higher-volume production facility. We are excited to expand our presence in Virginia supporting our nation’s critical space needs,” said Lorin Hattrup, General Manager, Trident Systems. “Our new production facility will allow us to support a range of products on rapid timelines while maintaining affordability.”

“Congratulations to the entire Trident Systems team as you expand your operations and continue to prosper here in Northern Virginia,” said Fairfax County Board of Supervisors Chairman Jeffrey C. McKay. “Your growth is yet another shining example of how companies supporting mission-critical operations in the space sector innovate and thrive in Fairfax County.”

“I am excited that Trident Systems and VEDP are partnering to bring these significant investments and jobs to the 36th Senate District,” said Senator Stella Pekarsky. “These partnerships will continue to expand Virginia’s role as a hub for high-tech industry, which will help our local economy grow and prosper. Partnerships like these will continue to help our region grow and support hard-working Virginia families.”

“The decision by Trident Systems to expand in Fairfax County is a great indicator of Virginia’s ability to foster new business and innovation,” said Delegate Karrie K. Delaney. “Especially as Chair of the House Transportation Committee, and Co-Chair of the General Assembly Aviation Caucus, I am excited to see this continued investment in the Commonwealth by a company that will create great aerospace jobs and commend both the Virginia Economic Development Partnership and the Fairfax County Economic Development Authority for their work to secure this project.”

Trident Systems, a LightRidge Solutions Company, has cemented its reputation for over three decades as a leader in multi-function space electronics and integrated C4ISR solutions. Using a rapid response, radiation effects-mitigated design approach for deployment in harsh environments, Trident has delivered semi-custom, high-performance RF and processing solutions at significantly lower cost than traditional space products. For more information, visit https://tridsys.com/.

Trident has been engaged with the Virginia Economic Development Partnership (VEDP) International Trade team since 2015 utilizing various programs and service offerings and is a 2020 graduate of the Virginia Leaders in Export Trade (VALET) program. VALET assists Virginia exporters that have firmly established domestic operations and are committed to international exporting as a growth strategy.

VEDP worked with the Fairfax County Economic Development Authority to secure the project for Virginia and will support Trident System’s job creation through the Virginia Jobs Investment Program (VJIP), which provides consultative services and funding to companies creating new jobs in order to support employee recruitment and training activities. As a business incentive supporting economic development, VJIP reduces the human resource costs of new and expanding companies. VJIP is state-funded, demonstrating Virginia’s commitment to enhancing job opportunities for citizens.